The Federal Deposit Insurance Corp. determined that the liquidity risk management component of the CAMELS rating for First Republic Bank was “too generous” prior to the San Francisco bank’s failure.

The agency, in a 63-page report debriefing First Republic’s collapse, noted that the bank’s business model and management strategies made it vulnerable to interest rate changes and the bank run that followed the failure of Silicon Valley Bank.

Regulators closed the $233 billion-asset bank on May 1 (the second-largest bank failure in U.S. history), and the FDIC arranged a sale to JPMorgan Chase.

The review found that the failure reflected “rapid growth and loan and funding concentrations, overreliance on uninsured deposits and depositor loyalty, and failure to sufficiently mitigate interest rate risk.”

Still, the bank had a composite “2” CAMELS rating in March 2023, “indicating that the overall condition of the bank was satisfactory,” the report said.

First Republic’s liquidity component was raised to a “1” in 2021, a move that the report said was “too generous and was inconsistent” given the bank’s high level of uninsured deposits.

The report acknowledged that the FDIC could have been “more forward-looking in assessing how rising rates” could hurt the bank, given its “concentration of lower-rate, longer-duration loans and dependence on low-cost funding and continual growth.”

The report determined that examiners could have done more to effectively challenge and encourage bank management to take steps to mitigate interest rate risk.

“We observed that over the four-year period of our review, First Republic doubled in size while actual examination hours declined by 11%,” the report said.

“While we would not expect examination hours to parallel asset growth and while there could be explanations such as examination efficiencies, on the surface, this trend appears counterintuitive and may have warranted greater explanation in annual supervisory plans,” the FDIC added.

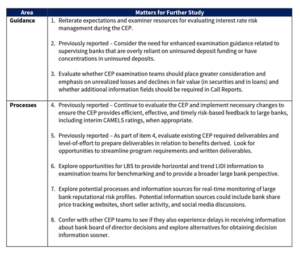

The internal review identifies eight items for additional review: