Community Bank System in Syracuse, N.Y., reported lower quarterly profit after joining the ranks of banks repositioning their balance sheets.

The $15.3 billion-asset company said in a press release that first-quarter net income fell 88% from a year earlier, to $5.8 million.

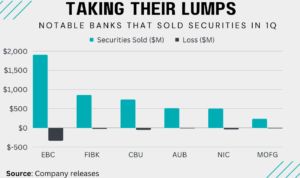

The company recorded a $52.3 million pretax loss after selling investment securities with a market value of $733.8 million. Net proceeds were used to pay down overnight borrowings with rising and “comparatively high” variable interest rates.

The company recorded a $3.5 million loan-loss provision “primarily due to an adverse change in the economic outlook.”

Total deposits increased by 0.8% from the previous quarter, to $13.1 billion.