Securities sales cut into first-quarter profits at First of Long Island in Melville, N.Y.

The $4.2 billion-asset company said in a press release that net income fell 46% from a year earlier, to $6.5 million.

The company recorded a $3.5 million loss from selling $149 million of fixed-rate municipal securities. It then bought $135 million of floating-rate SBA securities. The bank expects to earn back the loss in just over a year.

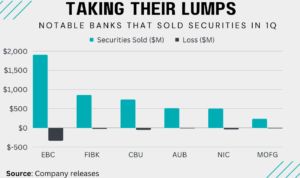

First of Long Island is one of several banks to absorb hits from securities sales.

The company also entered into an interest rate swap on March 16 to convert $300 million of fixed-rate mortgages to floating-rate for three years. The company said the swap is immediately accretive and should increase annual interest income by about $2.9 million.

Deposits fell by 1.9% from the end of 2022, to $3.4 billion.