First Republic Bank in San Francisco plans to cut 20% to 25% of its workforce.

The $233 billion-asset bank said in a press release the cuts will occur in the second quarter. Other cost-cutting moves will include “significant reductions” to executive compensation, condensing corporate office space and reducing nonessential projects and activities.

First Republic also said it is “pursuing strategic options to expedite its progress while reinforcing its capital position.”

While the bank’s deposit situation has stabilized, total deposits are down 41% since the failure of Silicon Valley Bank.

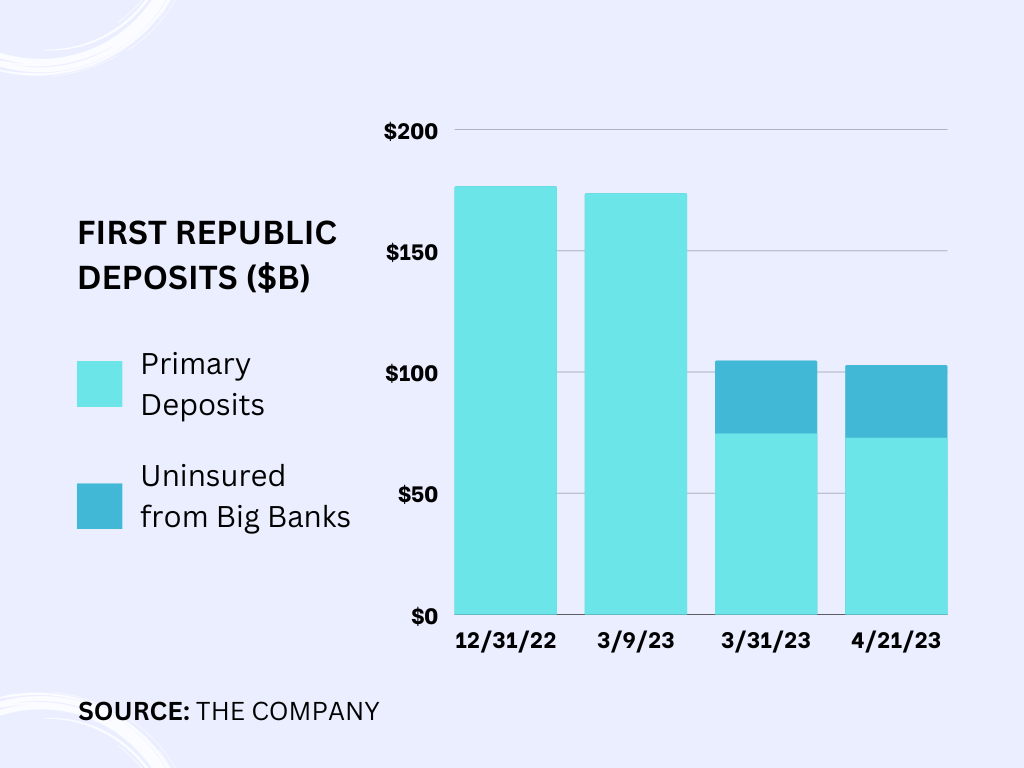

First Republic said deposit levels fell from $173.5 billion on March 9 to $102.7 billion on April 21. The latest total includes $30 billion of uninsured deposits from several large and regional banks.

First Republic said deposit activity began to stabilize the week of March 27 and has since remained stable. Deposits are down just 1.7% in the second quarter, “primarily reflecting seasonal client tax payments.”

Excluding the infusion of deposits from several big banks, the bank had $19.8 billion of uninsured deposits on March 31, or roughly 27% of total deposits.

Total borrowings fell by 25% between March 15 and April 21, to $104 billion, while cash and cash equivalents fell by 71%, to $10 billion. Long-term advances from Federal Home Loan Bank more than tripled between Dec. 31 and April 21, to $25.5 billion.

Net income available to common shareholders fell by 37% from a year earlier, to $229 million, reflecting higher deposit costs. Total interest income was $974 million in the first quarter, a significant increase from $44 million a year earlier.

In recent weeks, the bank has said that top executives will forgo bonuses and has suspended dividends on its common stock and certain types of preferred stock.