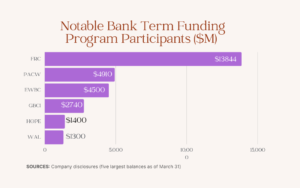

At least 19 banks have tapped into the Federal Reserve’s Bank Term Funding Program.

Those banks have borrowed more than $32 billion in BTFP funds, according to data compiled by S&P Global Market Intelligence.

The funding facility was formed in the wake of the high-profile failures of Silicon Valley Bank and Signature Bank to provide lenders with added liquidity. The idea is that the funds will keep banks from having to sell securities at a loss.

The biggest participant was First Republic Bank, which regulators closed on Monday.

At least one bank has disclosed a plan to exit the facility.

Western Alliance Bancorp. in Phoenix said it has agreements in place to sell $3 billion of loans, with plans to use the proceeds to pay off the BTFP funds.